Amazon’s Biggest Retail Competitors in the US

Similar to Oprah, Madonna, Apple, and Google, Amazon is now a household name. According to eMarketer, Amazon had an estimated 167.2 million Prime Members in the US alone in 2023—about half of the entire country’s population. Amazon has long gone uncontested as the world’s favorite online marketplace. But as online shopping has grown significantly over the past decade, there’s one marketplace that’s starting to catch up—Walmart.

Who are Amazon’s Competitors?

Walmart

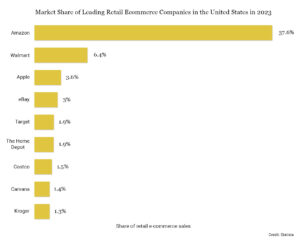

Amazon currently dominates the US e-commerce market with roughly 40% market share. Walmart has less than 10% but has grown faster than Amazon over the past five years—even surpassing it in 2022 revenue—due to its smaller start online and recently refocused efforts on e-commerce. Though Walmart is still much smaller than Amazon, it has figured out fulfillment, marketplace, and advertising, reaching $100 billion in online sales with over 100,000 active sellers on its marketplace.

The discount department store concept that is Walmart is quickly growing, finally giving Amazon some serious competition. While other marketplaces are seeing success, they are either too small, too niche, or not as good a substitute for Amazon as Walmart is. Walmart could very likely become a better alternative to Amazon soon, leveling out its e-commerce market share and leading to a better online market overall.

eBay

eBay has been replaced by Walmart as the second most important e-commerce channel, but it is still the third largest in the US. Statistics point to slow growth, however; while overall online spending has increased by 120% in the past five years, eBay was only up by 7%. In the early days, eBay was head-to-toe with Amazon, but its lack of growth and focus on enthusiasts and collectors paints eBay as a garage sale marketplace versus a general online marketplace like Amazon. eBay is too niche and small to truly compete.

Target

Target, on the other hand, has an online marketplace that is simply too small to compete with Amazon and Walmart with only 1,000 sellers, but the company itself boasts an extremely loyal following. Loyal Target customers love its convenience and even consider a trip to Target with their partner as a date. Very recently, the company revamped its guest-favorite loyalty program, Target Circle, with three new membership programs that aim to help customers shop and save in addition to getting free, same-day delivery through a paid membership.

With this update, Target hopes to continue its journey of long-term growth and profitability by prioritizing its strong relationships with shoppers. Target’s online presence is growing, but 70% of its e-commerce comes from same-day delivery, order pickup, and drive-up pickup. Target has increased its focus on online sales and could one day slice away at Amazon’s pie if it plays its cards right.

Other Marketplaces

- Shopify surpassed $200 billion in annualized GMV in 2024, but its marketplace app called “Shop” is making less than $1 billion a year.

- Temu, Shein & TikTok Shop are the most visible new marketplaces but only serve specific use cases, price points, and types of buying. Each will inevitably try to expand in selection and prices will grow. Like most other marketplaces, they are not a viable alternative to Amazon.

Key Takeaways

Amazon is 80% of the market for businesses that sell through online marketplaces. Its seemingly infinite selection and fast, free delivery sell Prime Memberships in itself. There are cases when buying from online stores, TikTok, eBay, Temu, etc. is better, but only Walmart comes close to being a meaningful competitor for Amazon. A bigger Walmart will only create a better alternative to Amazon, leveling out market share and leading to a better e-commerce market overall.

Macarta is Here to Help

We’ve helped brands large and small achieve major success on online marketplaces for nearly a decade, from Amazon and Walmart in the US to Mercado Libre in Mexico. With everything from content optimization to advanced advertising solutions, we’ve been pushing retail media to its limits to meet e-commerce trends and ensure major successes for our brand partners.

From our Denver-based headquarters, and with offices worldwide, Macarta is a global full-service marketplace agency specializing in retail media to drive growth and sustained success for our brand partners. Reach out to us here, and let’s get started!